FTIC has a proper implementation of Corporate Governance practices as integral to its operations. FTIC is committed to the principles of corporate governance issued by the Regulators.

The Board of Directors is committed to the ongoing implementation of corporate governance regulations to improve corporate governance for the interest of all stakeholders. FTIC’s operations are subject to an effective governance framework.

Furthermore, this framework enables our Board Members to balance their responsibility to provide oversight with their role as providers of strategic counsel, thereby achieving a proper balance between conformance and performance. In creating the governance framework, the Board is committed to applying accepted governance practices in a practical way.

Good corporate governance is contained in FTIC’s values, culture, processes, functions and organizational structure. Organizational structures are designed to formalize the oversight of all businesses and processes.

FTIC’s corporate governance philosophy is reflected by the values of transparency, professionalism and accountability. The company constantly strives towards betterment of these aspects and thereby perpetuates it into generating long term economic value for its shareholders, customers, employees, and other associated persons.

FTIC’s Corporate Social Responsibility conducting business in a socially responsible and ethical manner; Protecting the environment and the safety of people; Supporting human rights; Engaging, learning from, respecting and supporting the communities and cultures with which employees work

The following are corporate governance objectives of the company:

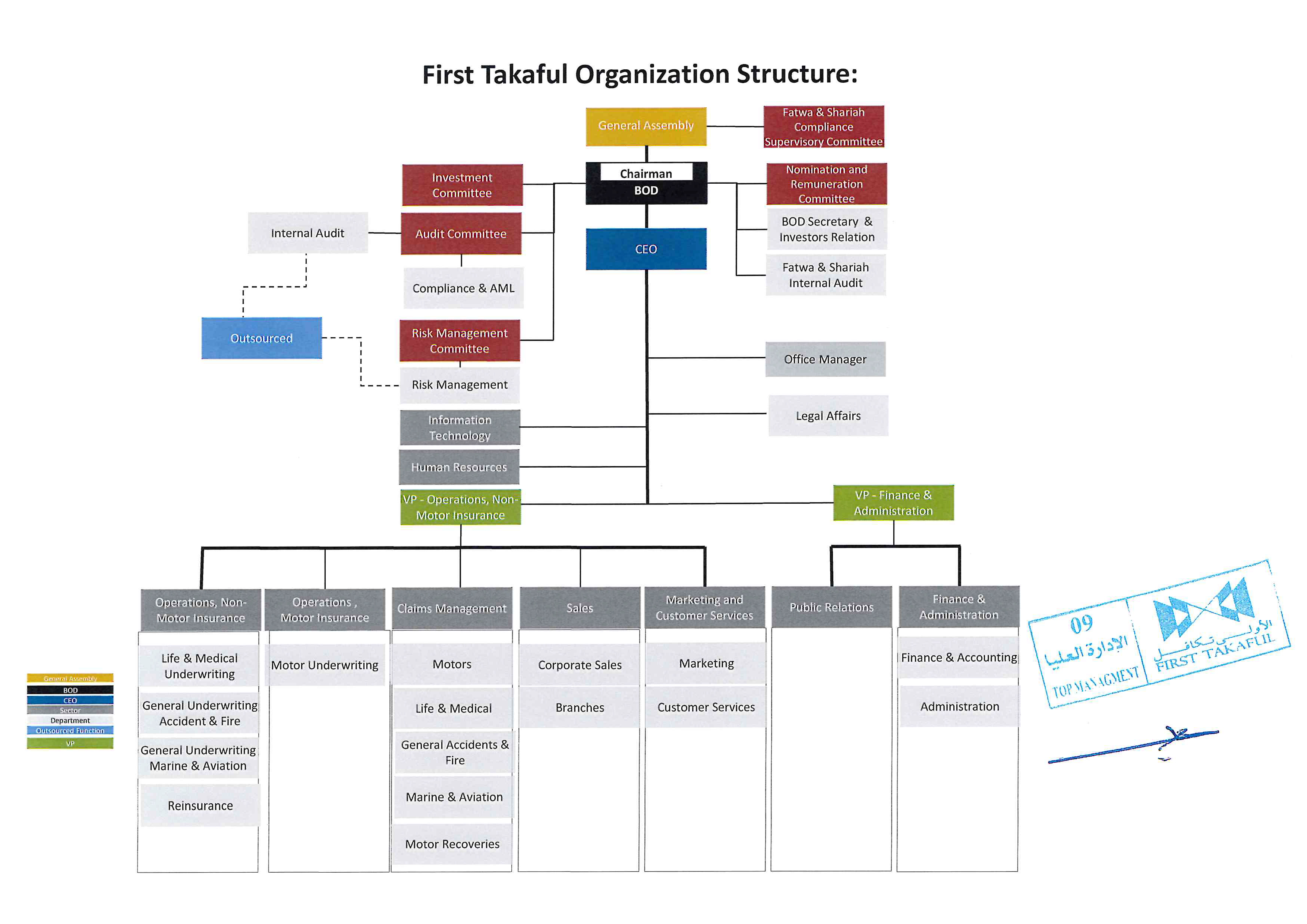

The organization structure at FTIC included a Corporate Governance Structure is shown below:

FTIC Board of Directors consists of 7 members and is elected in the General Assembly. The majority of the Board of Directors is Non-Executive Members and contained an independent member.

The Board of Directors has the academic and professional experience and specialized skills to manage the company’s activities, all the members are up to date with the Laws and regulations related to their rights and duties.

The board of directors form specialized independent committees in order to help the Board of Directors to undertake specific tasks and assist them to take decisions to protect the company’s interest and achieve company’s vision and mission.

FTIC’s code of conduct established the base of the framework against which we measure behavior, practices and activities to assess the characteristics of good governance. The FTIC’s code of conduct requires the Board Members and employees to conduct themselves with integrity at all times and displaying moral strength and behavior which promotes trust.

FTIC is committed to maintaining the highest standards of business conduct and ethics, as well as full compliance with all applicable government laws, rules and regulations, disclosure.

FTIC requires the employees to observe high standards of business and personal ethics in the conduct of their duties and responsibilities. The employees of the FTIC practices honesty and integrity in fulfilling their responsibilities and complying with all applicable laws and regulations. The Company has implemented an independent Whistle-blowing mechanism to report to the Compliance Officer.

FTIC has defined process to assess the performance of executive management and the Board of Directors. The criteria for assessment depending on the KPIs and is pre-defined and communicated to them prior to the commencement of the evaluation period.

FTIC has defined a succession plan policy, which may be a process for identifying and developing internal people with the potential to fill key business leadership positions in FTIC. FTIC is seeking to increase the availability of experienced and capable employees that FTIC prepared them to assume these roles as they become available.

FTIC has established a guideline for the board, management and employees to protect the interests of FTIC when it is contemplating entering into a transaction, arrangement or other work that might be direct or indirect benefits with private interest for Board member, management and employees. All concerned parties at FTIC should adhere to the guidelines related to conflict of interest, and disclosure of such potential incidences to protect the integrity and reputation of FTIC.

FTIC is adopting strong disclosure and transparency standards for both financial and non-financial information to boosts investor confidence and elevates the overall corporate governance environment

FTIC has enhanced the rules to ensure adequate transparency in its activities and disclose relevant information to its stakeholders.

FTIC adopts a policy for Shareholders’ Protection Rights based on the principles of transparency and equal treatment; FTIC commit to provide the shareholder with comprehensive, equal and understandable information about FTIC on a timely basis, in order to enable them to exercise their rights in an informed manner, and also to allow them to strengthen the communication with FTIC.

FTIC respects the rights of the shareholders, including compliance with all applicable laws and regulations.

FTIC adopts a policy for Stakeholder’ Protection Rights based on the principles of principles of respect and appreciation. FTIC enhance relationships with clients and vendors to adopt and maintain confidentiality with their information.

FTIC established a separate unit “Investor Relations” that act as an intermediary between the Company, its investors and the community at large. The Unit is responsible to provide the investors with a timely and accurate picture of the company, its financial performance, strategy and outlook.

FTIC identified the following as primary Stakeholders:

The Compliance Department of the FTIC is a control function that has the ability to objectively assess and express its views on the policies and practices of other functions/departments in relation to compliance.

The Compliance Department is responsible for identifying and communicating relevant compliance standards, clarifications and regulatory requirements to relevant departments. The departments in turn shall be responsible for translating and merging the regulatory requirements into internal policies and procedures.

The Compliance Department is responsible for reviewing all process documents to determine whether the regulatory requirements have been adequately captured in the documents.

In order to effectively and efficiently manage compliance risk, the Compliance Department works in close coordination with the Internal Audit and Risk Management Departments.

The Risk Management Department is an independent Function that involves identifying and tracking risk areas, developing risk mitigation plans as part of risk handling, monitoring risks and performing risk assessments to determine how risks have changed. Effective risk management is a key element of good corporate governance in companies and the board bears primary responsibility for risk management. The scope of the Risk Management Department includes the following:

The Internal Audit Department is an independent department; they have direct line of reporting to the audit committee / Board of Directors functionally activities. In addition to the administratively reporting line to the Chief Executive Officer. the internal Audit Department try to maintain unbiased matters during handling Internal Audit activities:

The Internal Audit Department is responsible to:

FTIC is committed to the Company’s practices and expectations relating to corporate values through its commitment to grow in a socially and environmentally responsible way, while meeting the interests of its stakeholders including shareholders, customers, employees, suppliers, business partners, local communities and other organizations.

FTIC working to protect the environment and the safety of people; supporting human rights; and Engaging, learning from, respecting and supporting the communities and cultures with which employees work